IL IL-425 2019-2025 free printable template

Show details

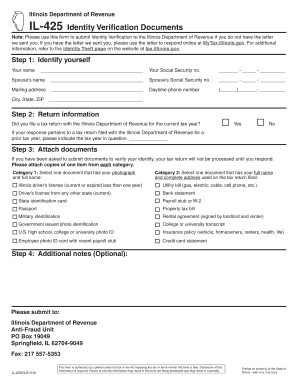

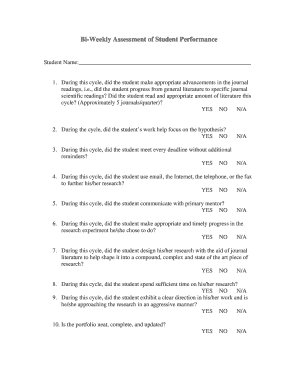

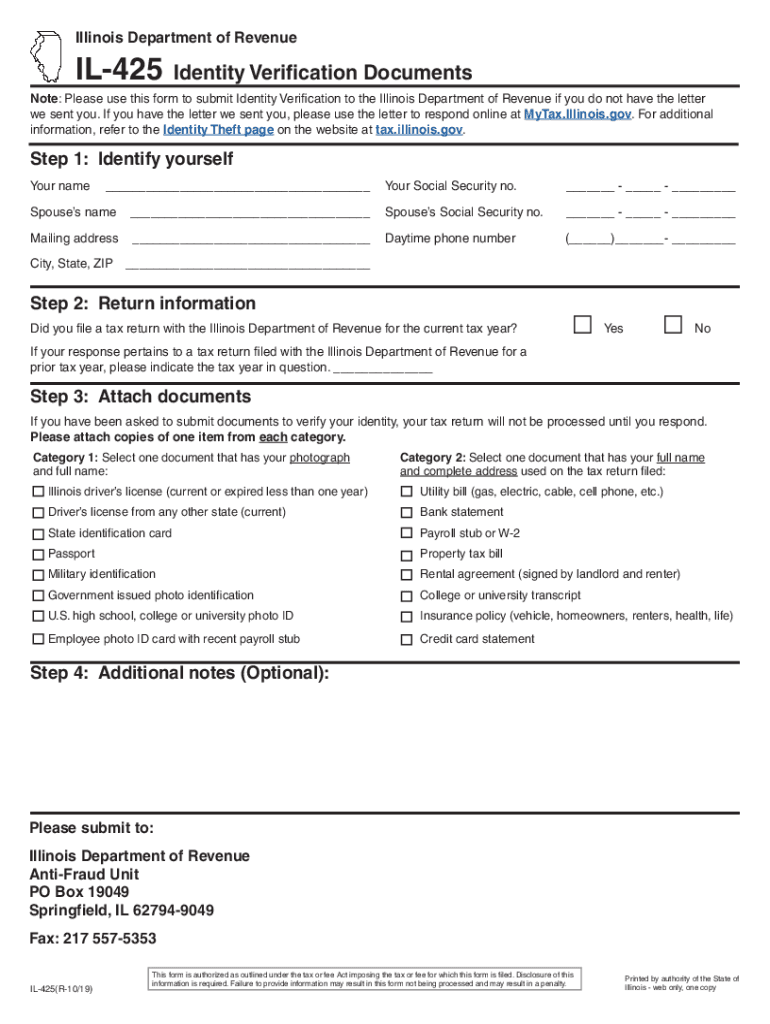

Use your mouse or Tab key to move through the fields. Use your mouse or space bar to enable check boxes. Illinois Department of RevenueIL425 Identity Verification Documents

Note: Please use this form

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign il 425 form

Edit your IL IL-425 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IL IL-425 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit IL IL-425 online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit IL IL-425. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IL IL-425 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out IL IL-425

How to fill out IL IL-425

01

Obtain the IL IL-425 form from the Illinois Department of Revenue website or your local revenue office.

02

Enter your full name, address, and taxpayer identification number at the top of the form.

03

Fill in the appropriate tax year for which you are filing.

04

Complete Section A by providing the total income that qualifies for the specific exemptions.

05

In Section B, list any specific deductions or credits you are claiming.

06

Calculate your total deduction amount and ensure it is correct.

07

Review your form for completeness and accuracy, making sure there are no omissions.

08

Sign and date the form to certify the information provided is accurate.

09

Submit the completed form to the appropriate Illinois state tax authority.

Who needs IL IL-425?

01

Individuals or businesses in Illinois who are seeking certain tax exemptions or deductions.

02

Taxpayers who need to report specific income sources and calculate their tax liabilities.

Fill

form

: Try Risk Free

People Also Ask about

How do I prove my identity to the IRS?

More In News Social Security numbers and birth dates for those who were named on the tax return. An Individual Taxpayer Identification Number letter if the you have one. Your filing status. The prior-year tax return. A copy of the tax return in question. Any IRS letters or notices you received.

Why did I get an Identity Verification letter from Illinois Department of Revenue?

If you receive an Identity Verification letter after you file your Illinois tax return, it does not mean your identity has been compromised. It is simply a check to make sure YOU or your authorized designee filed the return, and it was not an unauthorized individual attempting to commit fraud.

How do you attach a document to IL 425?

Add the IL 425Irs Tax FormsIdentity Document for editing. Click on the New Document option above, then drag and drop the file to the upload area, import it from the cloud, or using a link.

How do I identify my identity with the IRS?

Other Ways to Verify Your Identity Your 5071C letter, 5747C letter, 5447C letter, or 6331C letter. The Form 1040-series tax return for the year shown on the letter. Note: A Form W-2 or 1099 is not tax return. Any other prior year tax return, if you filed one. Any supporting W-2s, 1099s, Schedule C, Schedule F, etc.

Why is the IRS asking me to verify my identity?

We received a federal income tax return, Form 1040-series, filed under your Social Security number (SSN) or individual tax identification number (ITIN). We need you to verify your identity and your tax return so we can continue processing it. If you didn't file a tax return, let us know.

How can I verify my identity?

How to verify your identity Your State-Issued ID. You can upload a photo of your ID by phone or by computer. Don't have a state issued ID? Social Security number. Your phone number. If we can't verify your phone number, you can verify by mail instead which takes approximately 3-7 business days.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Who is required to file il 425irs tax formsidentity?

Anyone who owns a business in Illinois and conducts activities subject to Illinois income tax is required to file Form IL-425, Illinois Income Tax Return.

How to fill out il 425irs tax formsidentity?

To fill out the IL-425-IRS Tax Form, you will need to provide your name, address, Social Security Number (SSN), and other information about your filing status. You will also need to provide information about your income, deductions, and credits. Certain sections of the form may require additional information, such as bank accounts, investments, or business income. Make sure to read all instructions carefully and provide all the necessary information.

What information must be reported on il 425irs tax formsidentity?

The information that must be reported on Illinois 425-IRS tax forms includes the taxpayer's name, address, Social Security number, filing status, income, deductions, credits, and any other information required to calculate the taxpayer's tax liability.

What is il 425irs tax formsidentity?

IL-425-IRS tax form refers to the Illinois Income Tax Payment Voucher for Individuals. It is a form used by residents of Illinois to submit their tax payments to the Illinois Department of Revenue. The form helps in identifying the taxpayer, their tax liability, and the amount of payment being made.

Can I create an electronic signature for signing my IL IL-425 in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your IL IL-425 directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

How can I edit IL IL-425 on a smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing IL IL-425.

Can I edit IL IL-425 on an iOS device?

Use the pdfFiller mobile app to create, edit, and share IL IL-425 from your iOS device. Install it from the Apple Store in seconds. You can benefit from a free trial and choose a subscription that suits your needs.

What is IL IL-425?

IL IL-425 is an Illinois tax form used for reporting the income and expenses of partnerships and limited liability companies (LLCs) that are classified as partnerships for income tax purposes.

Who is required to file IL IL-425?

Partnerships and LLCs that conduct business in Illinois and have any income that needs to be reported to the state must file IL IL-425.

How to fill out IL IL-425?

To fill out IL IL-425, gather financial information about the partnership or LLC, including income, deductions, and credits. Then complete the form by entering the required information in the designated fields, following the instructions provided by the Illinois Department of Revenue.

What is the purpose of IL IL-425?

The purpose of IL IL-425 is to report income earned by the partnership or LLC, allocate income to partners or members, and calculate the total tax owed to the state of Illinois.

What information must be reported on IL IL-425?

The information that must be reported on IL IL-425 includes the partnership or LLC's income, contributions by partners or members, deductions, credits, and information about each partner or member's share of the income and losses.

Fill out your IL IL-425 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IL IL-425 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.